Table of Contents

- 🤖 What Kavout Does and why it matters

- 📊 How the AI analysis works

- 🧾 Quick demo: From question to research (example: Apple)

- 📈 Technicals and swing-trade setups

- 🔎 Find ideas faster: Discover, Smart Signals, and scans

- 💼 Portfolio toolbox: build, diagnose, optimize

- 💵 Pricing and lifetime deal

- ⚖️ Strengths and limitations

- ✅ Who should use Kavout?

- 🔧 How I use Kavout in my workflow

- 🧠 Final verdict

- ❓FAQ

- 📚 Further reading and next steps

🤖 What Kavout Does and why it matters

Kavout is an AI-powered stock research platform that compiles fundamentals, technicals, analyst commentary, news sentiment, and more into a single actionable report. I use it as a time-saver: instead of spending hours digging through financial statements, chart patterns, and articles, Kavout summarizes the multi-dimensional picture and suggests an action—hold, buy, or sell—along with conviction and a time horizon.

📊 How the AI analysis works

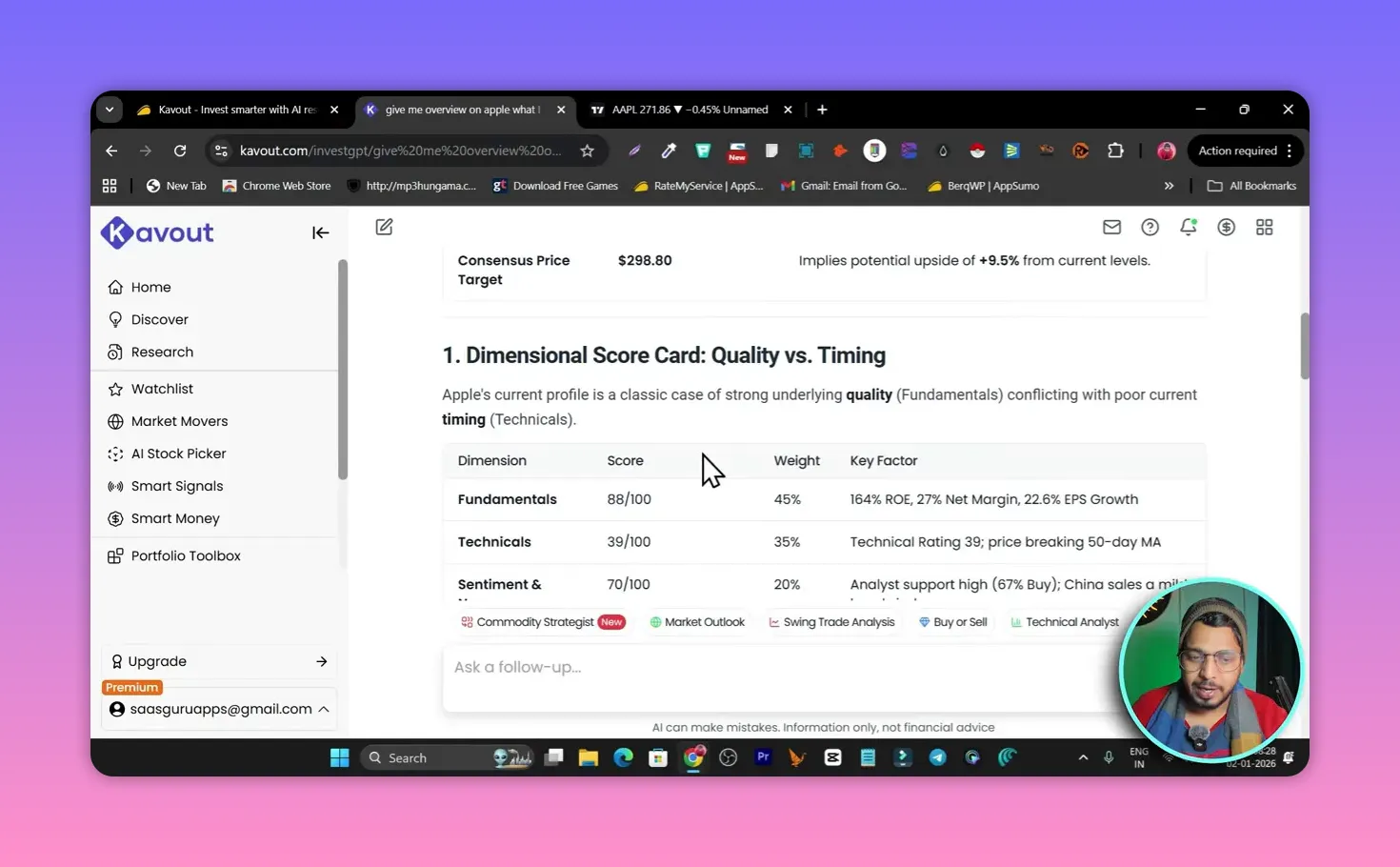

The engine crawls public sources and market data, runs machine learning models, and produces a scorecard for each ticker. That scorecard typically includes:

- Fundamental analysis — ROE, margins, earnings trends and valuation metrics

- Technical analysis — moving averages, breakout signals, short-term setups

- Sentiment and news — recent headlines and market reaction

- Actionable plan — recommended action, target price, stop loss and time horizon

The result is a single, readable recommendation backed by the supporting data that you can cross-check on your charts and confirm before trading.

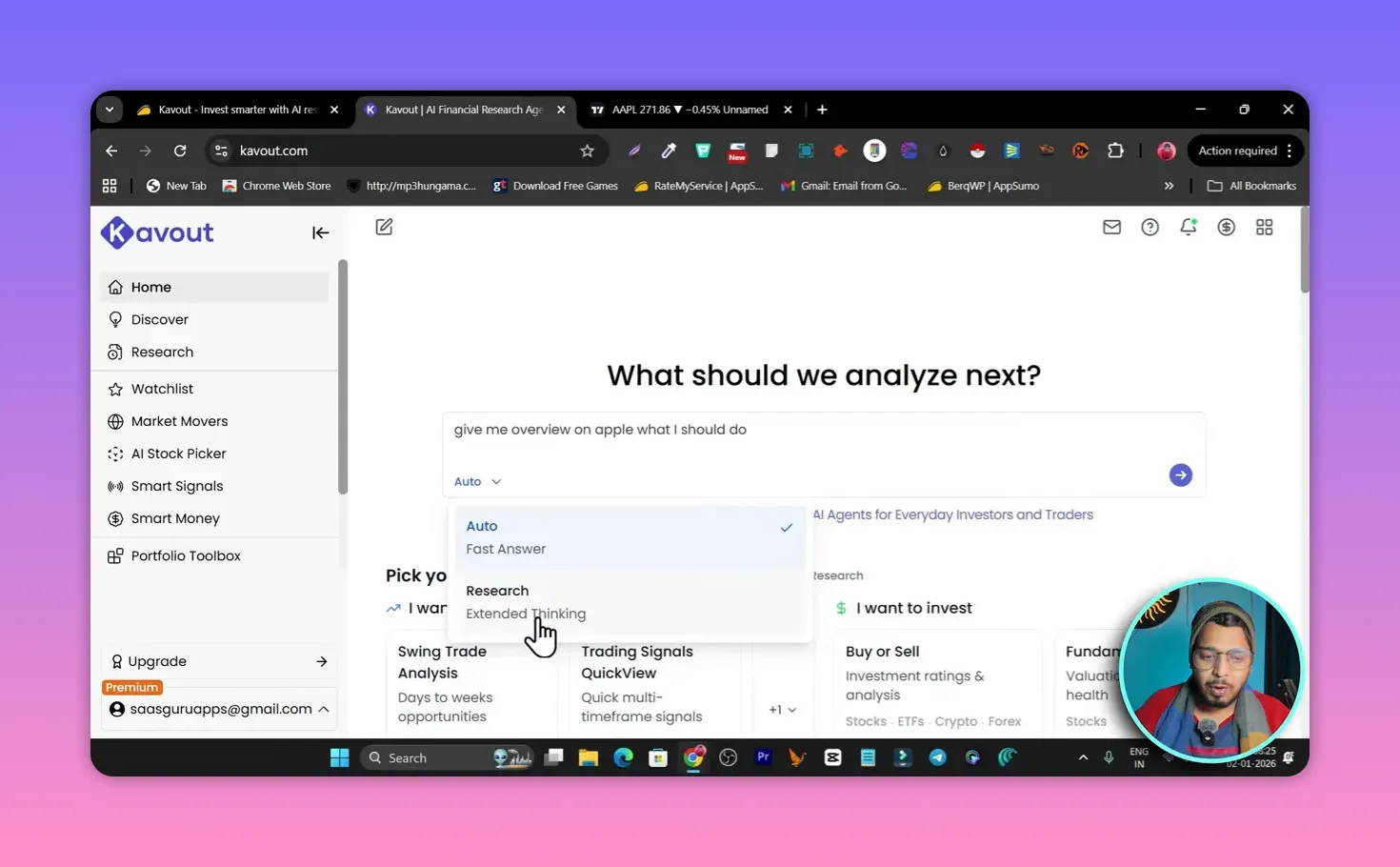

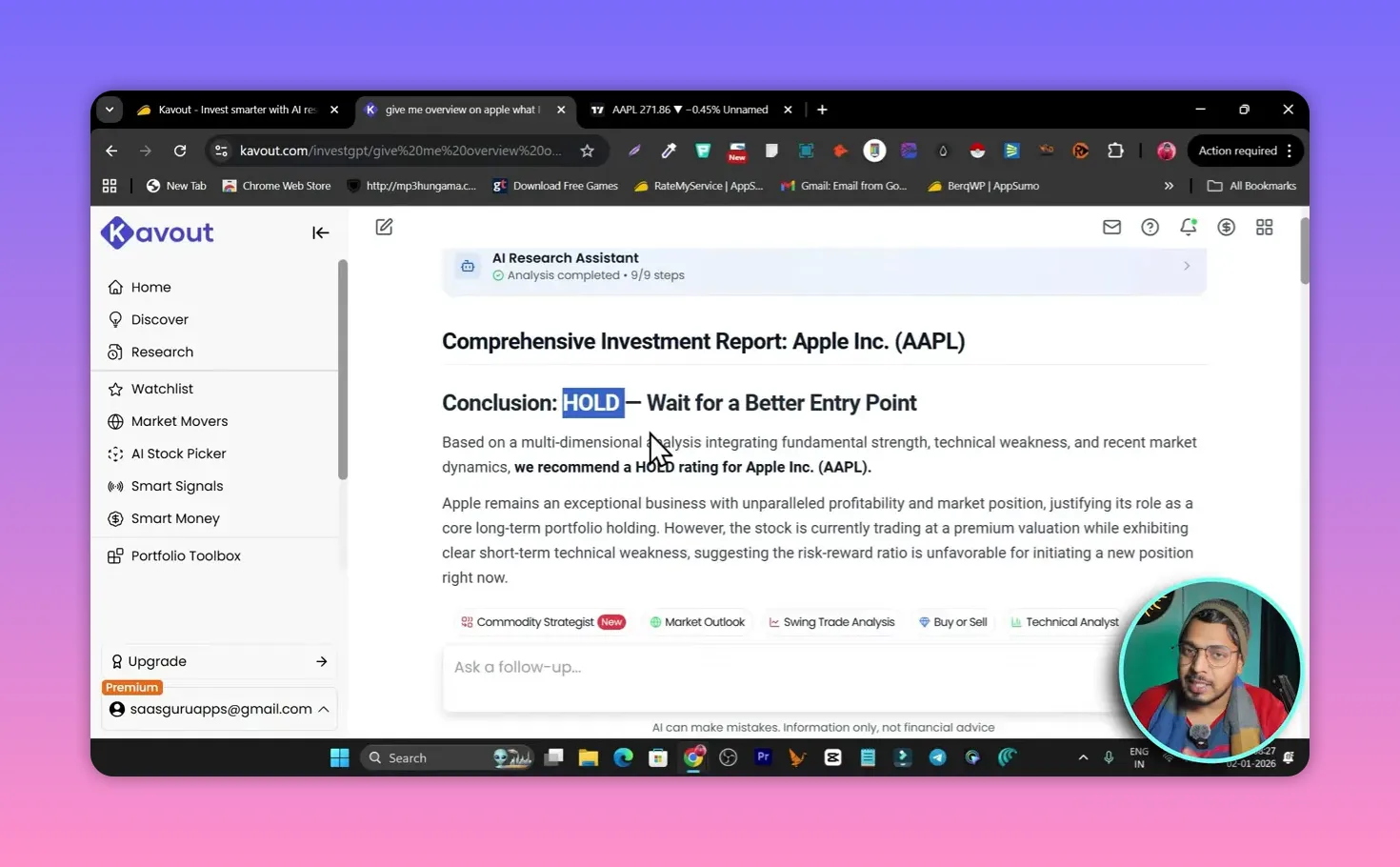

🧾 Quick demo: From question to research (example: Apple)

Ask Kavout for an overview of a ticker and the AI runs an “extended thinking” research process. In my test with Apple, Kavout returned a consolidated report that recommended hold with a conviction of 55/100 and a 3–12 month time horizon. It highlighted high valuation versus strong fundamentals and noted weak short-term technicals.

The platform shows the current price relative to key moving averages (for Apple it displayed price near the 25 EMA), and explains why the recommendation makes sense. That mix of explanation plus numbers is the core value: it saves time while still letting you verify the rationale on the chart.

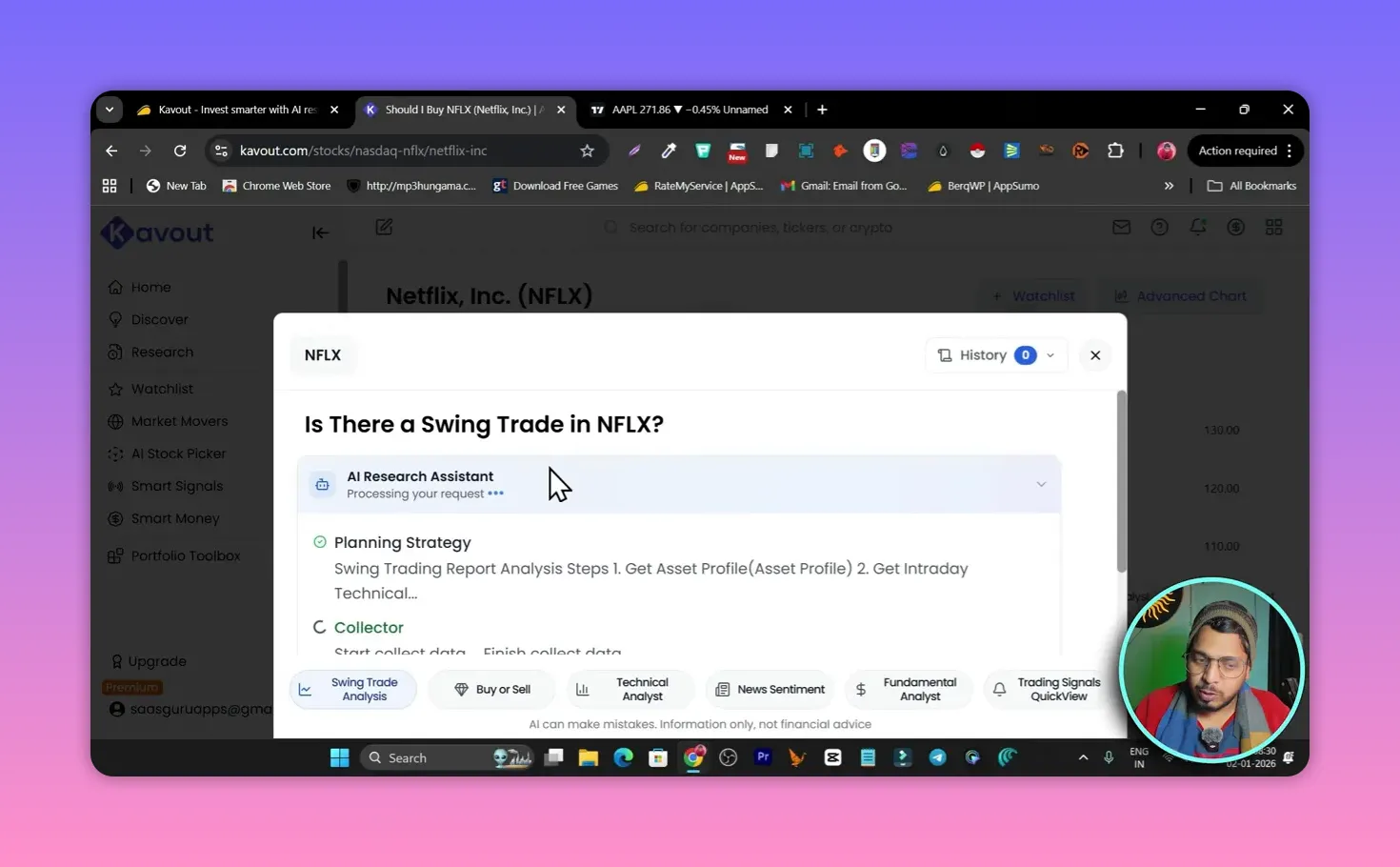

📈 Technicals and swing-trade setups

Kavout offers specialized analysis for short-term traders—swing trade suggestions include entry confirmation, stop loss, and target levels. For example, a near-term setup will highlight a four-hour trend or a required daily breakout before entering.

These signals are useful if you already trade using price-action rules. The AI doesn’t remove the need to verify chart conditions; it streamlines the identification and shows the key levels to watch.

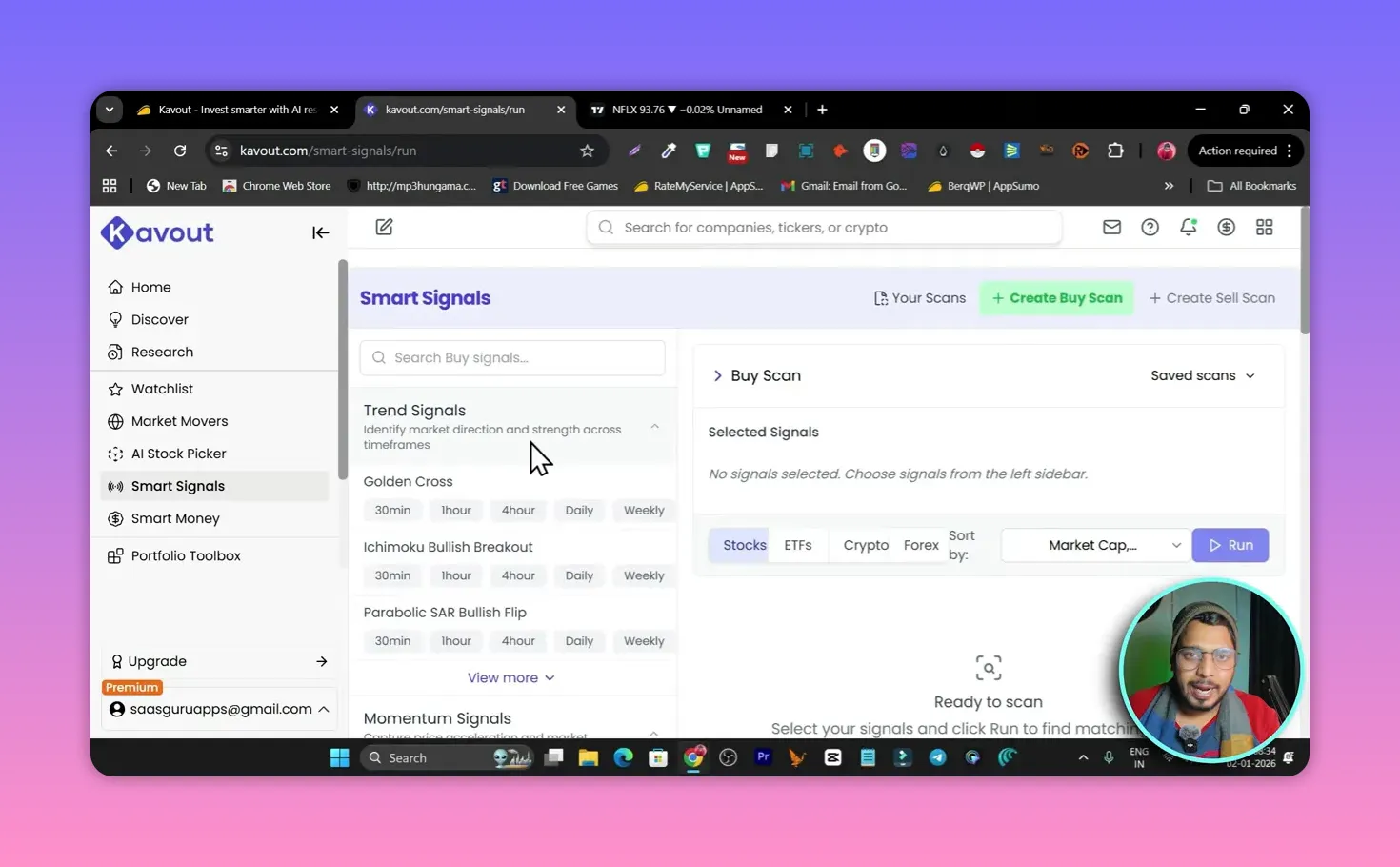

🔎 Find ideas faster: Discover, Smart Signals, and scans

Kavout bundles idea generation tools:

- Discover — curated articles and market stories for major stocks.

- Smart Signals — prebuilt strategies like golden cross scans on specific time frames.

- Custom scans — build buy scans or trend-based filters and run them across the universe.

The platform also surfaces market movers (top gainers/losers, 52-week highs/lows) and aggregates analyst insights, insider trades, and other “smart money” footprints in one place.

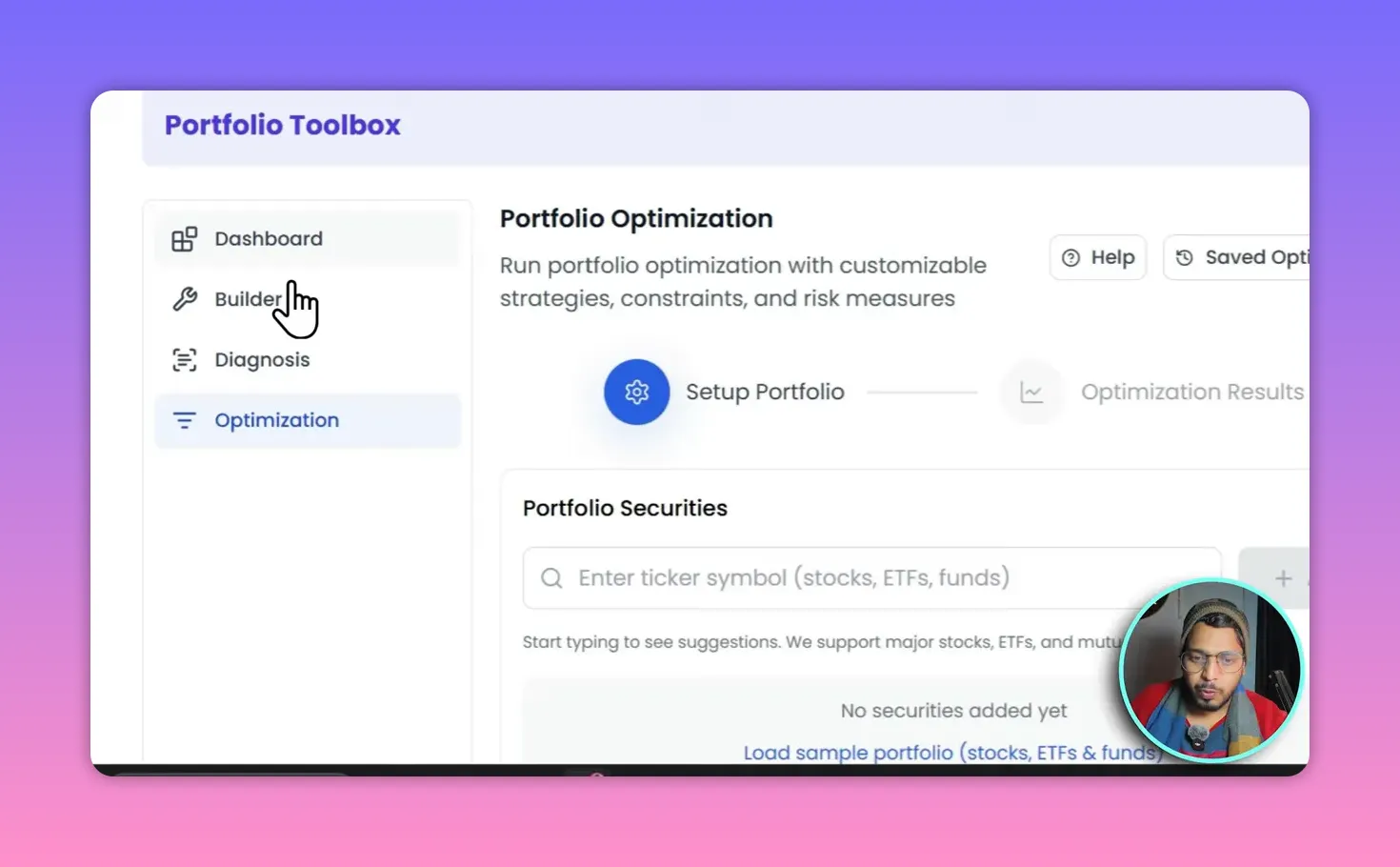

💼 Portfolio toolbox: build, diagnose, optimize

Beyond single-stock research, Kavout includes a portfolio builder and optimizer. Connect your holdings, analyze allocation, run diagnostics, and get suggestions to improve diversification or expected performance.

This turns Kavout into more than a stock screener. It becomes a portfolio assistant that can help you rebalance or stress-test positions using the same AI signals that power single-stock reports.

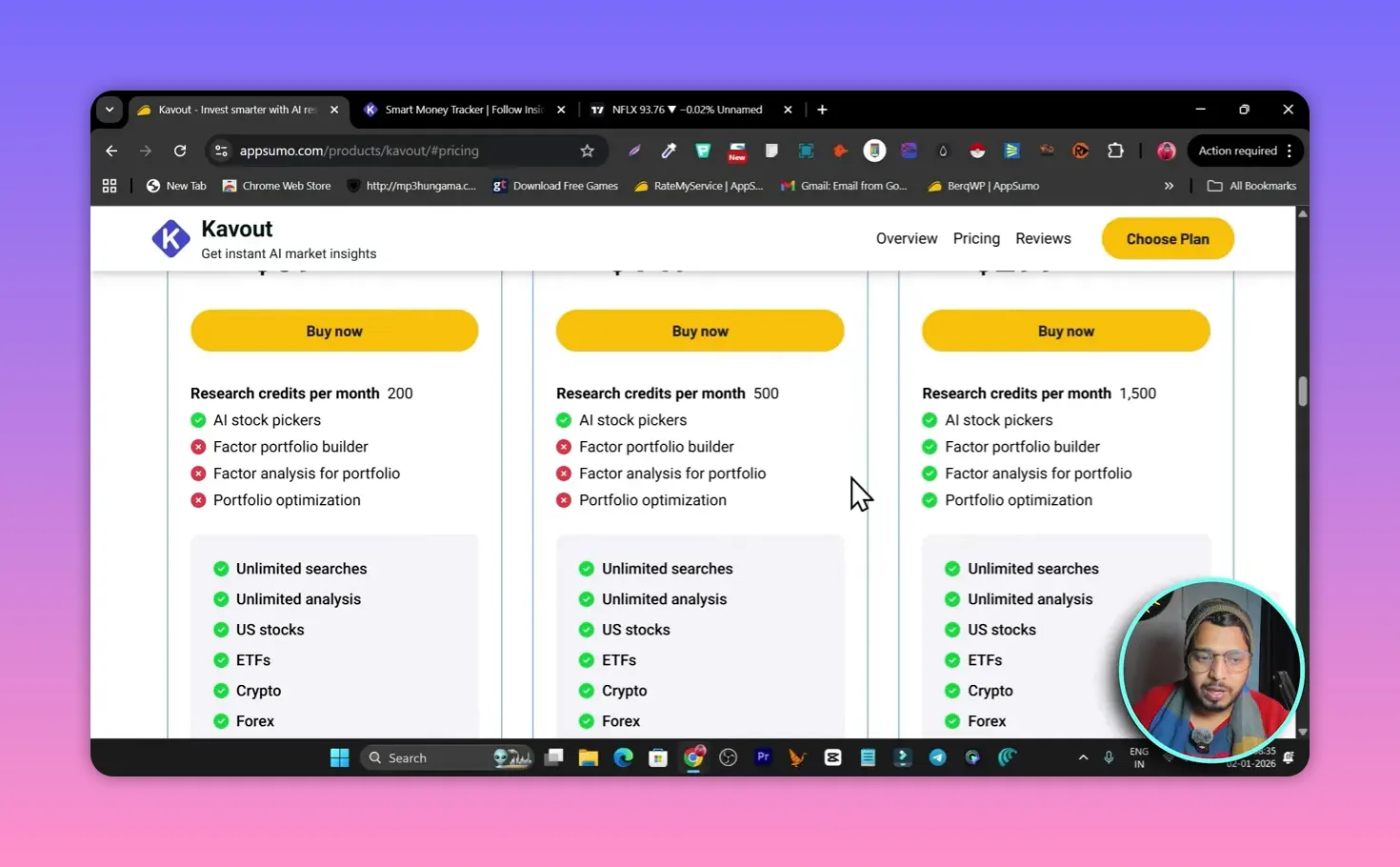

💵 Pricing and lifetime deal

Kavout is offered with tiered plans. A lifetime deal was available through AppSumo at a one-time price starting around $69. The full feature set—advanced AI research, unlimited scans, and portfolio tools—typically requires the higher tier. A lifetime option removes monthly subscription friction, which can be attractive if you plan to use the product regularly.

⚖️ Strengths and limitations

Kavout shines at time savings and idea generation. It compiles millions of data points into readable recommendations and gives traders a checklist: fundamentals, technicals, sentiment, catalysts and headwinds.

- Strengths

- Saves hours of manual research

- Clear, actionable plans with targets and stops

- Works across stocks, ETFs, crypto and commodities (US market focus)

- Limitations

- Currently focused on the US market only

- AI suggestions require human cross-checking—do not blindly follow them

- Some advanced features gated to higher tiers

✅ Who should use Kavout?

Kavout is useful for:

- Beginners who need structured, easy-to-interpret research

- Long-term investors who want a fundamental + valuation snapshot quickly

- Active traders and swing traders who need short-term setups and level-based entries

It’s not a replacement for critical thinking. Use Kavout to accelerate research, then verify levels and thesis against your own rules.

🔧 How I use Kavout in my workflow

Start with a stock overview for a high-level read. If the action is interesting, expand into:

- Check fundamentals and conviction score

- Open technical analysis and inspect key MA relationships and trend structure

- Run swing trade or short-term scan for entry, stop, and target

- Cross-check news and sentiment for any near-term catalysts or headwinds

- If it fits, add to a mock or real portfolio and run diagnostics

That approach keeps the AI as an assistant, not an oracle.

🧠 Final verdict

Kavout is a practical AI stock picker that meaningfully reduces research time and delivers clear, multi-dimensional recommendations. It will not replace investor judgment, but it does let you work faster and focus your attention where it matters.

If you want faster idea generation, systematic screening, and a portfolio assistant under one roof, Kavout is worth evaluating—especially if you can secure a lifetime deal to avoid recurring subscriptions.

❓FAQ

Is Kavout accurate enough to trade from its signals alone?

Kavout provides high-quality, data-driven signals and clear trade levels. However, accuracy is never guaranteed. Use the signals as a starting point, verify chart structure and news, and apply risk management. Treat AI output as guidance, not a trading directive.

Which markets does Kavout cover?

Kavout currently focuses on the US market. Expansion to other markets like Australia and Canada has been discussed, but at present the coverage is US-only.

Can I use Kavout for ETFs and crypto?

Yes. Kavout supports stocks, ETFs, crypto and commodities in its research and screening tools, letting you apply the same AI filters across different asset types.

Is a lifetime deal worth it?

If you plan to use Kavout regularly and the lifetime tier includes the features you need, a one-time payment can be a strong value compared with recurring subscription costs. Confirm which features are included in the tier before buying.

Does Kavout replace manual analysis?

No. It speeds up research and surfaces opportunities, but manual cross-checking of charts and company fundamentals remains essential. Use Kavout to reduce busywork and improve decision quality.

📚 Further reading and next steps

Try a few tickers through the platform, run the discovery and smart scans, and connect a small demo portfolio to see the diagnostics in action. The best way to judge an AI research tool is to compare its output with your current workflow and measure the time saved and the quality of the trade ideas.